If you’re in the legal or financial world, you’ve probably heard the buzz about SEC Forms 3, 4, and 5. These filings are a big deal when it comes to transparency and compliance, especially concerning insider trading disclosures. But with regulations constantly evolving, managing these forms manually feels like juggling flaming swords. That’s why automation and modern platforms like Form345.com are game-changers. These forms exist to keep corporate insiders—like directors and officers—accountable when it comes to trading company stock. They’re part of the Securities Exchange Act of 1934, and they help regulators and investors see who’s buying or selling shares behind the scenes. The data can affect stock prices, investor trust, and company credibility.

Who Needs to File These Forms?

Typically, officers, directors, and beneficial owners of more than 10% of a registered class of a company’s equity securities must file. Each form captures different stages of ownership or transactions. It’s not just about compliance—it’s about transparency and ethics.

Understanding SEC Form 3

Form 3 is the starting line. It’s the initial filing that an insider makes when they first acquire securities. Think of it like the “Hey, I’m here!” form for new executives or major shareholders. Within 10 days of becoming an insider, the person must file Form 3. Missing this deadline? That’s a regulatory red flag—and a potential penalty. Automation makes sure you never miss that 10-day window. Form 3 requires details about the person’s relationship to the company, as well as the number and type of securities owned. It may look simple, but get even a single field wrong and you’re in hot water.

Deep Dive into SEC Form 4

SEC Form 4 is all about changes—buying or selling shares after you’ve filed Form 3. Every time an insider makes a transaction; this form needs to be filed—usually within two business days. Missing the 2-day window for Form 4 is a serious offense. It can lead to SEC scrutiny, fines, and even lawsuits. That’s why platforms like Form345.com are crucial—they keep the timeline tight and accurate. Errors often include incorrect transaction codes, failure to report indirect ownership, and late filings. These slip-ups can snowball into bigger problems. Automation drastically reduces these risks.

What is SEC Form 5?

Form 5 is more like a yearly wrap-up. It includes transactions that should have been reported earlier but weren’t, or those exempt from Form 4.Filed within 45 days after the end of the fiscal year, Form 5 acts as a final audit. If you missed something, this is your last chance to report it cleanly. Not everyone has to file Form 5 every year. If you’ve disclosed everything promptly via Forms 3 and 4, you’re off the hook. But if you’re unsure, automation tools help determine whether filing is needed.

Automation in SEC Filing Processes

The beauty of automation? No more spreadsheets, calendar alerts, or late-night panics. Filing platforms powered by intelligent automation, like Form345.com, take the stress off your shoulders. Manual data entry is a breeding ground for errors. Automation ensures consistency and accuracy, flagging potential problems before submission. Imagine trimming your form filing time from hours to minutes. That’s the reality with automation. Your team can now focus on strategic tasks instead of paperwork.

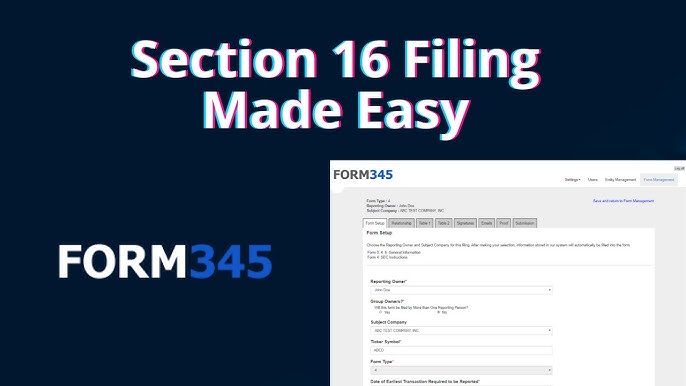

The Role of Form345.com

Form345.com is a robust platform that automates SEC Form 3, 4, and 5 filings with precision. It’s tailored for both legal and financial teams who crave simplicity without sacrificing accuracy The platform ensures compliance by integrating filing rules directly into its system. You don’t have to be a securities lawyer to get it right.Form345.com enables real-time filing so that forms are submitted on time—every time. No delays, no forgotten submissions.

Ease-of-Use in Modern Filing Platforms

Modern SEC filing tools are built with user experience in mind. No more clunky systems or confusing interfaces. Clean dashboards, guided forms, and validation checks make the filing experience seamless, even for non-tech-savvy users. Platforms like Form345.com connect with HR, legal, and finance systems to pull insider data automatically. That’s seamless reporting without double entry. In a world of data, reporting is everything. Real-time dashboards and detailed analytics give legal and finance teams the insight they need.

Real-Time Data Analytics Compliance Tracking

Track filings, monitor insider activity, and generate compliance reports on the fly. It’s transparency at your fingertips. You’ll know who filed what and when. This is especially useful during audits or regulatory reviews. Lawyers love precision—and automation tools deliver that in spades. They simplify SEC requirements into an intuitive process. By removing guesswork, legal teams can ensure all filings are accurate and defensible.

Simplifying Legal Audits and Financial Sector Benefits

During due diligence or investigations, digital records and audit trails are gold. Filing platforms offer them effortlessly. In finance, insider activity is sensitive. Transparent filings inspire investor confidence and protect market integrity. Timely SEC Form 4 disclosures reveal insider actions, reducing the risk of market manipulation. A transparent company is a trustworthy one. Compliance builds reputation and trust, especially in volatile markets. One large-cap company slashed filing errors by 90% using Form345.com. Another reported a 70% reduction in turnaround time. That’s not theory—it’s fact. Delays, errors, and uncertainty plague manual filing processes. But with automation, these headaches become a thing of the past.

How Automation Solves Them

From deadline reminders to error checks, automation anticipates problems before they happen. You stay proactive, not reactive. The key to flawless compliance? Set reminders, train your team, and use the right tech. With automated alerts and calendar integrations, you’ll never miss a critical date again.

Training and Team Awareness and AI and Machine Learning in Compliance

Equip your team with knowledge and tools. An informed team is your best defense against compliance failures. Expect even more innovation—AI, predictive analytics, and tighter integration with the SEC’s own systems. Soon, platforms will not just help file—they’ll predict when and what you need to file. That’s smart compliance.

Conclusion

SEC Forms 3, 4, and 5 are essential to corporate transparency and legal compliance. But let’s face it—manual filing is outdated. Platforms like Form345.com bring automation, ease-of-use, and advanced reporting to the table, making life easier for legal and financial professionals alike. If you’re still stuck in the old way of doing things, it’s time for an upgrade.